Hi, we're Freeman,

we’re more than a

global events company.

We produce more

than trade shows.

We design more

than experiences.

Because what

we really do is

create connections.

July - April 2022

Our return to LIVE: Events by the numbers

Inspire your audiences to take action. And look good doing it.

Inspire your audiences to take action. And look good doing it.

Inspire your audiences to take action. And look good doing it.

Inspire your audiences to take action. And look good doing it.

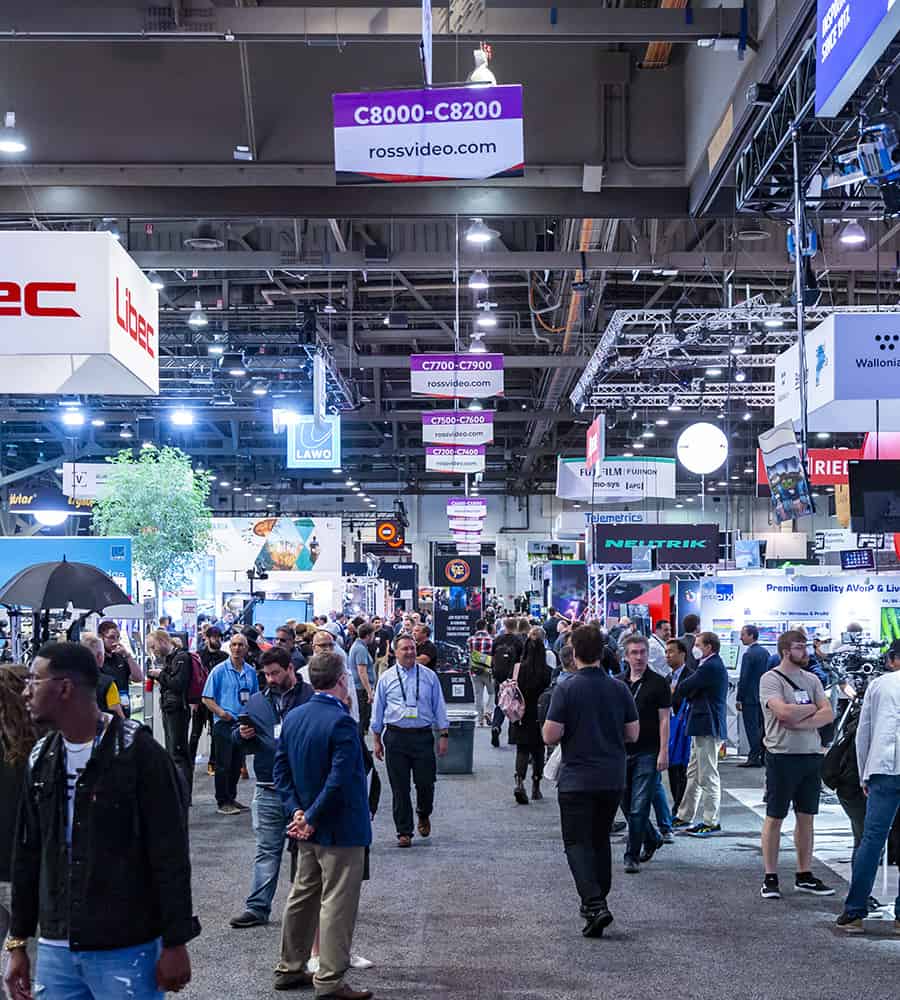

Let's design your annual trade show

Execute a flawless exhibition, attract the right attendees, deliver better ROI for sponsors, and make it easier for exhibitors.

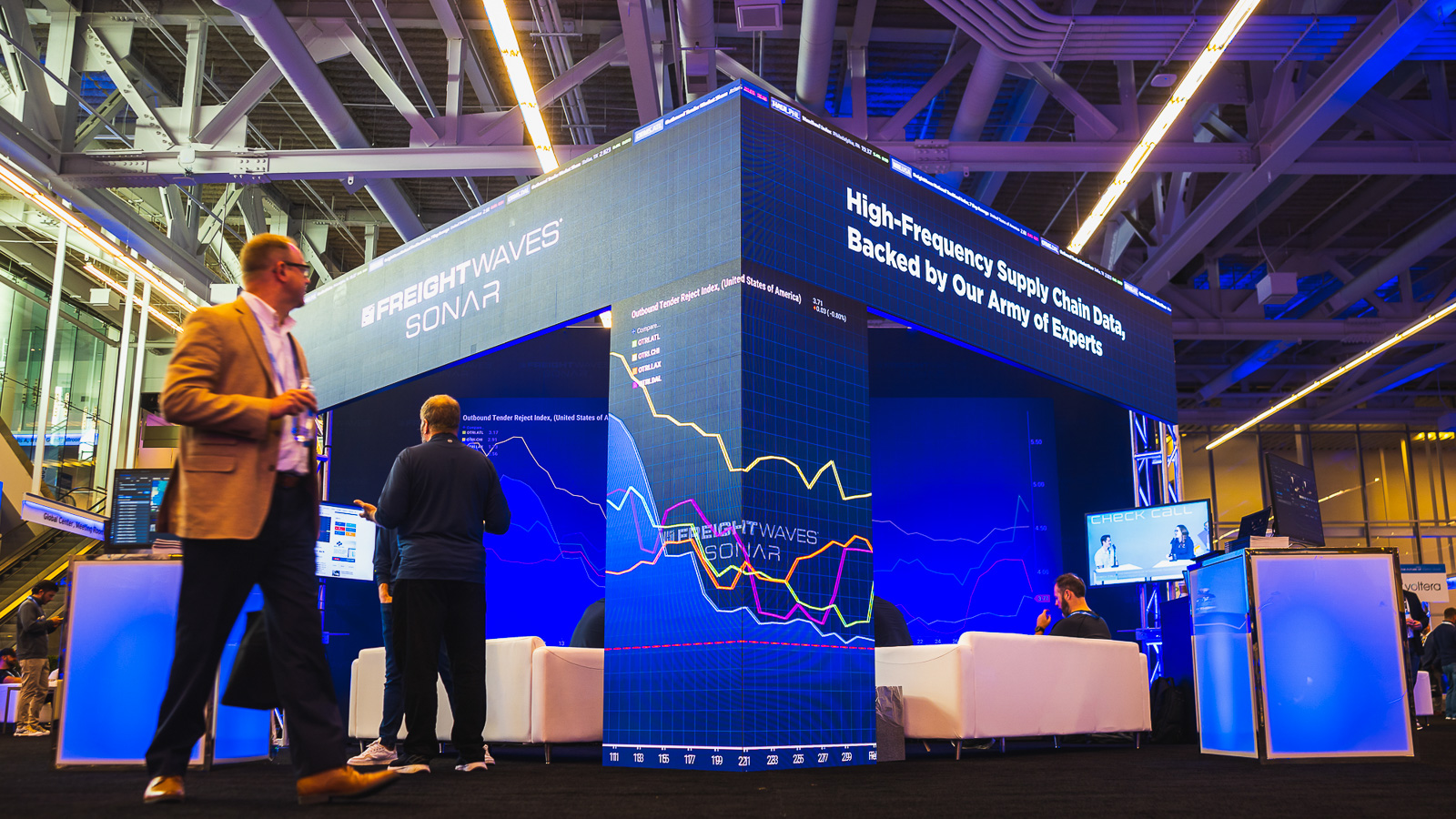

Let's design your attention-grabbing exhibit

Create a memorable experience that grabs attendees’ attention. Accomplish all of your goals at any size and budget.

Let's design a more powerful story

Create more powerful stories in a way the audience wants to hear them, so you can deliver what they want and what they need.

We do award-winning work for a wide range of clients.

Forbes Best Employer for Women

- Ranked #5 in the business services and supplies category

- Ranked #83 out of 400 companies overall

The list was compiled by surveying 50,000 Americans, including 30,000 women, working for businesses with at least 1,000 employees.

Event Marketer, It List

The experiential industry’s first and only guide to the best agencies and partners in the business.

Event Marketer, EDTA

The world’s only recognition program honoring the best use of design, social media, A/V, and event technology to enhance live experiences.

EventEx, Top 150 Event Organizers & Agencies in USA

Represents consistent excellence in the event industry, it features the most awarded agencies and event organizers in the USA.

NorthStar Meetings Group, Sue Sung Listed

The 15 difference-makers we chose to profile here did exemplary work for the benefit of their colleagues, clients and communities when they needed it most.

Let's Get Started

Reach out and request a consultation.

Reach out and request a consultation.